Updated: Sep 19, 2023

Key Points:

- Industry Evolution: Australia’s Child Care Services industry has shifted from a fragmented to a structured sector, serving 1.3 million children.

- Mixed Performance: The industry’s revenue growth faces challenges like low occupancy rates and staff shortages despite a 1.8% growth projection.

- Pandemic Impact: COVID-19 exposed vulnerabilities, but essential funding supported the industry’s operation.

- Future Growth: Anticipated 4.0% annual revenue growth, reaching $17.9 billion by 2027-28, driven by maternal labour force participation and government funding.

- Challenges: Workforce shortages, potential policy reforms, changing ownership dynamics, and adapting to hybrid work environments are key challenges for providers.

Australia’s Child Care Services industry has experienced significant shifts and challenges recently. As the nation strives to provide quality early childhood education and care, this article explores the industry’s current landscape and promising future.

The Evolving Industry

Australia’s Child Care Services industry has transitioned from a fragmented landscape to a more structured sector driven by public and private investments. Today, it caters to approximately 1.3 million children aged 12 and under, offering government-approved or funded childcare services. This industry encompasses various providers, including for-profit and nonprofit organisations, contributing to its diverse composition. HCPA specialises in assisting Child Care providers with multiple aspects of their operations. From registration and compliance to growth strategies, HCPA provides the expertise needed to navigate the complex landscape of the childcare industry successfully.

Navigating Mixed Performance

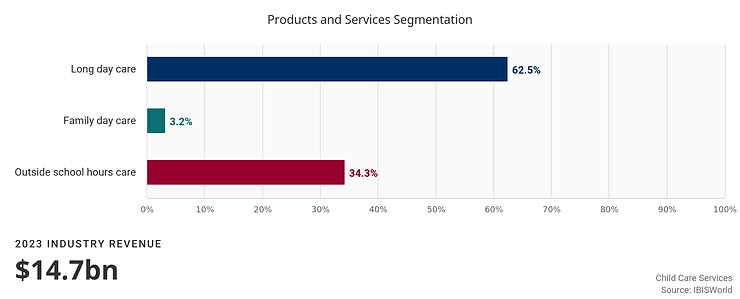

The industry has seen mixed performance over the past five years leading up to 2022-23. While it anticipates annualised revenue growth of 1.8%, reaching an estimated $14.7 billion, it has grappled with several challenges. Increased government spending, rising enrollments, and higher fees bolstered initial growth. However, this expansion was offset by the rapid proliferation of new childcare facilities, resulting in low occupancy rates and staff shortages.

The Pandemic’s Impact

The COVID-19 pandemic posed unprecedented challenges for the Child Care Services industry. While this financial support was critical, the pandemic exposed vulnerabilities, including low occupancy rates and staffing issues, which continue to affect operators.

Future Growth and Opportunities

The industry anticipates robust annualised revenue growth of 4.0% over the next five years, reaching an estimated $17.9 billion by 2027-28. Several factors will underpin this growth:

- Maternal Labor Force Participation: Higher maternal labour force participation rates will drive increased demand for childcare services, supporting industry growth.

- Government Funding: Increased government funding will play a pivotal role in ensuring the accessibility and affordability of childcare services for families across Australia.

Challenges on the Horizon

Despite the promising outlook, the industry faces several challenges that demand attention:

- Workforce Shortages: Ongoing skilled labour shortages hinder the industry’s growth potential, with thousands of vacancies reported in late 2022. Calls for government-funded pay raises for early childhood educators persist.

- Policy Reforms: The new Labor Government’s commitment to equitable and affordable childcare may lead to significant policy reforms, which childcare providers must navigate.

- Ownership Dynamics: The entry of corporate operators has reshaped the ownership landscape, with further acquisitions and changes in ownership expected.

- Adaptation to Changing Environments: Providers must adapt to meet the evolving needs of parents in the hybrid working environment, offering flexibility and premium services.

HCPA provides providers with the tools and strategies to address these challenges head-on; and ensures providers are well-prepared for the changing landscape, from workforce management solutions to policy compliance guidance.

Key Success Factors

Childcare providers must focus on critical success factors to thrive in this evolving landscape:

- Cost Management: Effective cost controls are essential to maintain viability, especially during periods of low demand.

- Government Support: Leveraging government assistance programs is crucial for attracting families and achieving profitability.

- Regulatory Compliance: Strict adherence to the National Quality Framework and government regulations is essential for maintaining quality standards.

- Strategic Location: Strategically located in areas with sufficient demand is a critical success factor for childcare providers.

Australia’s Child Care Services industry stands at the cusp of transformation. While challenges exist, such as workforce shortages and policy reforms, the industry’s growth potential is promising. Providers must remain adaptable, invest strategically, and uphold quality standards to navigate this evolving landscape successfully. HCPA supports Child Care providers at every step, offering expertise in registration, compliance, growth, and more. The industry’s capacity to address these challenges will shape its future and contribute to the nation’s early childhood education and care efforts.

Join the burgeoning early childhood community and positively impact the younger generation and their families. Contact us here or call 03 9084 7472 to learn how we can help you succeed.

SOURCES | IBISWorld ‘Child care services in Australia’ |