Key points:

- Childcare’s Vital Role: Childcare in Australia is a crucial family support system, facilitating parents’ work, study, or volunteering commitments while ensuring children receive essential care and education.

- Factors Influencing Choice: Affordability is a primary concern for households, and while it influences childcare decisions, competition in the sector is driven more by non-price factors such as location, availability, safety, and educator-child connections.

- Future Prospects and ACCC’s Inquiry: The ACCC’s inquiry into childcare services is a pioneering effort to comprehend the sector comprehensively, including cost structures, competitive dynamics, and parental preferences. The goal is to guide policy decisions for equitable, accessible, and high-quality childcare services for Australian families.

Childcare is a linchpin in Australian society, serving as a pivotal support system for families and a nurturing environment for the early development of over a million children. The Australian Competition and Consumer Commission (ACCC) has embarked on a crucial inquiry into childcare services, focusing on prices, supply, demand, and the impact of the Child Care Subsidy. HCPA is dedicated to assisting providers in delivering the highest standards of care and compliance with the complex regulatory landscape in the childcare sector.

Nurturing Our Future: The Significance of Childcare

Childcare is not just necessary for working parents; it is a platform where children receive education and care, fostering their growth in a safe, enriching environment. For parents, accessible and affordable childcare is vital, enabling them to pursue careers, studies, or volunteering opportunities.

The ACCC’s inquiry, the first of its kind, delves into four distinct childcare services eligible for the Child Care Subsidy: centre-based daycare, family daycare, outside-school hours care, and in-home care.

Gaining Insights: The Scope of the Inquiry

The inquiry is underpinned by an extensive dataset, providing insights into the costs associated with providing childcare services, spanning large, medium, and small providers. This robust data collection represents a pioneering effort to comprehend the childcare sector from multiple angles, aiming to inform government decisions on policies and support for Australian families and children.

The Childcare Landscape in Australia

In 2022, a staggering 1.09 million children aged five and under and 655,000 children aged 6–13 were enrolled in childcare services. This constitutes 60% of all 0–5-year-olds and 25% of 6–13-year-olds in the country.

However, growth in approved childcare places has not been uniform across services or geographic regions. Centre-based daycare and outside school-hours care dominate, forming 97% of all childcare services. On the other hand, family daycare and in-home care services have declined, disproportionately affecting households in vulnerable situations.

Local Dynamics: Understanding Childcare Markets

The interim report highlights the localised nature of childcare markets. Parents and guardians typically opt for childcare centres within a short radius of around 2 kilometres. This emphasises the importance of proximity when choosing a childcare service.

Additionally, competition is intense within these localised markets, especially for centre-based daycare services, where numerous operators compete within a 2 to 3-kilometre radius. Most outside school-hours care services are associated with a primary school, with sessions of care provided on the school premises to children who attend that school.

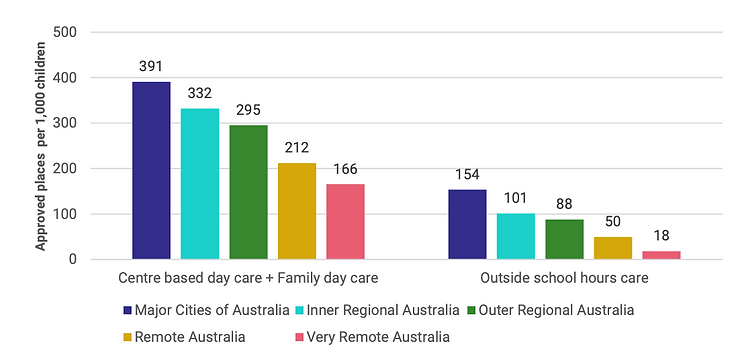

We also found that there are more childcare places available per child, on average, in Major Cities, with the number of general sites reducing the more remote an area (figure 1).

Figure 1: Approved childcare places per 1,000 children by remoteness, 2022

Source: ACCC analysis of ACECQA and Department of Education administrative data.

This interim report has also examined the mix of childcare services by a local area’s relative socio-economic advantage and disadvantage level.

The mix of centre-based day care, outside school hours care, family day care and in-home care differs by the socio-economic characteristics of an area. The more advantaged an area, the higher the share of outside school hours care; the less advantaged an area, the higher the percentage of family daycare.

Also, as an area’s socio-economic advantage increases, the share of children enrolled in childcare tends to be higher.

Factors influencing parents’ and guardians’ choice

For many households, childcare is a necessity. Preliminary results from a voluntary survey of parents and guardians undertaken by the ACCC for this inquiry suggest that affordability is the most important first consideration for households when deciding how much formal childcare to use.

Access to the Child Care Subsidy helps many households afford some childcare. However, households must undertake approved activities to be eligible for the Child Care Subsidy. This requirement may exclude or limit some families from accessing and using more childcare services.

Childcare markets appear unlike markets for other essential services, such as electricity, telecommunications and transport, which offer substantially the same product to users and compete on price.

Competition in childcare emerges more substantively through non-price factors and service differentiation than price.

Once households have decided how much childcare they can afford, parents and guardians appear to focus on considerations other than price when choosing a specific service.

Parent and guardian choice focuses on location, availability, safety and security and connections with educators. This is understandable – parents and guardians want to know their child is safe and well cared for, and they may not necessarily seek the lowest price in the market.

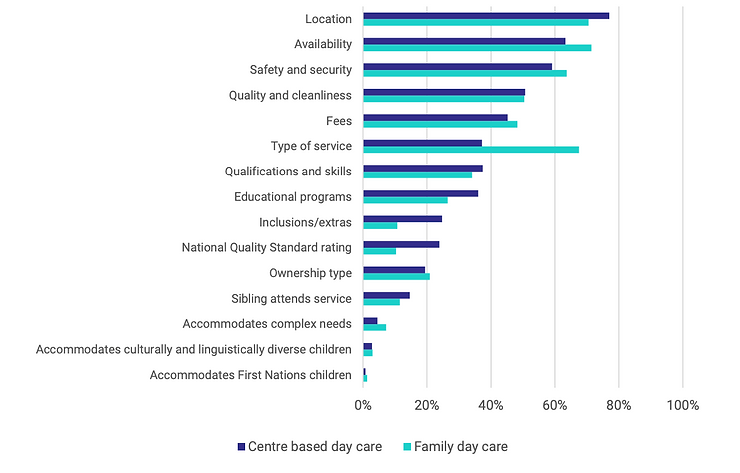

Location is the most common consideration when parents choose formal childcare. Most parents and guardians told us they wanted a childcare service close to home, and the maximum time most were willing to travel was up to 15 minutes. Availability, safety and quality were more commonly considered than the price for centre-based daycare. Fees were the 5th or 6th most commonly considered factor, depending on the childcare service (figure 2).

Figure 2: Parent and guardian considerations when choosing childcare – preliminary results from ACCC parents and guardians survey

Sources: ACCC voluntary parents and guardians survey.

Influential Factors: Parental Considerations

Affordability emerges as a primary consideration for households when determining the extent of formal childcare usage. The Child Care Subsidy is critical in enhancing affordability, but eligibility criteria can restrict access for specific families.

HCPA is offering vital assistance to childcare providers. Intriguingly, unlike other essential services where price is a significant factor, competition in the childcare sector is primarily driven by non-price factors and service differentiation. When selecting a childcare service, parents focus on location, availability, safety, and educator-child connections.

A Glimpse into the Future

The ACCC’s inquiry into childcare services is an essential step in unravelling the intricacies of this critical sector. By comprehending cost structures, competitive dynamics, and parental preferences, this inquiry aims to provide valuable insights to guide policy decisions and ensure equitable, accessible, and high-quality childcare services for Australian families.

As the inquiry unfolds, stay tuned for subsequent reports that will delve deeper into the world of childcare services, unveiling a comprehensive understanding of this indispensable facet of our society.

HCPA is an all-in-one solution for Child Care providers, supporting them with registration, growth and consulting. Contact us here or call 03 9084 7472 to learn how we can help you succeed.

SOURCES | Australian Competition & Consumer Commission ‘Childcare Inquiry Interim Report’ |