Key Points:

- Market Growth: The Australian healthcare providers sector witnessed significant growth, reaching $150.9 billion in 2022 and is projected to grow to $184.1 billion by 2027, indicating a 22% growth since 2022.

- Segmentation: Inpatient care is the largest segment, constituting 48.7% of the sector’s total value. Outpatient care holds a significant share of 20.4%, reflecting evolving healthcare preferences towards less intensive care options.

Forces Shaping the Sector:

- Buyer Power: Individual consumers and health insurance companies significantly influence pricing and services, balancing affordability and quality.

- Supplier Power: Suppliers, including hospitals and pharmaceutical companies, hold considerable sway, emphasising product quality and reliability.

- Threat of New Entrants: Stringent regulations and capital requirements act as barriers to entry, requiring a solid reputation and adherence to quality standards for new players.

The healthcare providers sector in Australia has been on a remarkable growth trajectory, underscoring its vital role in the country’s overall well-being and economic landscape. In this article, we explore the critical aspects of this sector, including its market value, segmentation, geographical impact, competitive landscape, and the forces shaping its dynamics.

Market Value and Forecast

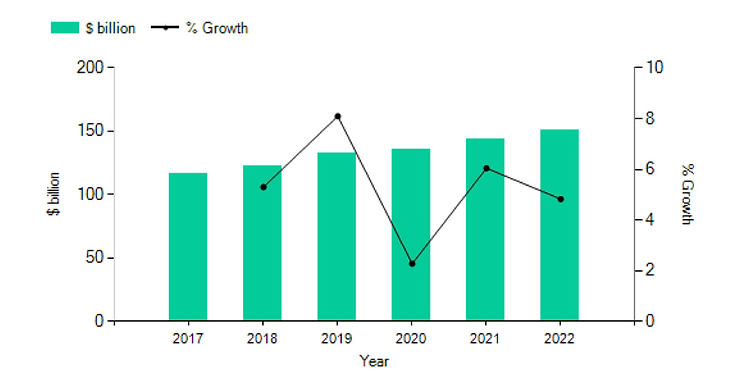

In 2022, the Australian healthcare providers sector witnessed a robust growth of 4.8%, reaching a substantial value of $150.9 billion. The industry is projected to continue this upward trajectory, with a forecasted value of $184.1 billion by 2027. This anticipated growth of 22% since 2022 is indicative of the sector’s resilience and potential for further expansion. HCPA (HCPA) is dedicated to assisting healthcare providers in navigating this growth, ensuring compliance with regulations, and fostering excellence in the healthcare sector.

Australian healthcare providers sector value: $ billion, 2017-22

Segmentation: Understanding the Landscape

Inpatient care emerges as the largest segment within the healthcare providers sector, constituting 48.7% of the sector’s total value. This highlights the importance of hospital-based services and specialised care that necessitates hospitalisation. On the other hand, outpatient care holds a substantial share of 20.4%, signalling the evolving healthcare preferences towards outpatient and less intensive care options. HCPA provides comprehensive guidance and support to healthcare providers in optimising their service delivery across various segments, ensuring the highest quality of care.

Geographical Impact: Australia in the Asia-Pacific Realm

Australia plays a notable role in the Asia-Pacific healthcare providers sector, accounting for 6.4% of its total value. The sector’s growth in 2022 can be attributed to rising income levels and an increasing emphasis on health awareness among the populace. The Australian government’s active involvement and support are fundamental in shaping and nurturing the healthcare landscape.

Competitive Landscape and Market Rivalry

Competition within the healthcare provider sector is driven by efficiency, quality of care, and pricing. Larger hospitals face intense rivalry and benefit from scale economies, enabling them to negotiate more assertively on price. Notably, the significant growth in sector expenditure has mitigated rivalry levels, ensuring a focus on quality and patient care. HCPA assists healthcare providers in understanding and effectively responding to market competition, enabling them to enhance their services while maintaining a competitive edge.

Forces Shaping the Sector

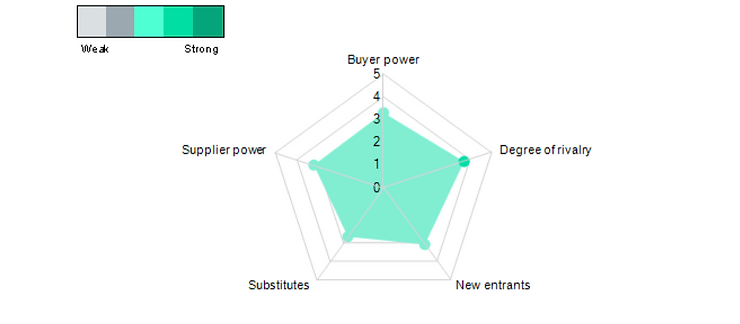

- Buyer Power: Both individual consumers and health insurance companies wield significant influence, impacting pricing and services. The balance between affordability and quality of services is crucial to meet buyer expectations.

- Supplier Power: Suppliers, including hospitals, pharmaceutical companies, and healthcare equipment providers, have considerable sway. The quality and reliability of their products play a pivotal role in the sector’s functioning.

- Threat of New Entrants: Stringent regulations and capital requirements present barriers to entry, emphasising the need for a solid reputation and adherence to quality standards for new players.

- Threat of Substitutes: The preventive healthcare approach, promoting a healthy lifestyle to prevent diseases, is a potential substitute for traditional healthcare services.

HCPA provides strategic insights and support to healthcare providers to effectively navigate these market forces, ensuring their services are aligned with consumer demands and industry standards.

Forces driving competition in the healthcare providers sector in Australia, 2022

The Australian healthcare providers sector’s growth underscores its pivotal societal role. Understanding market dynamics and effectively navigating the competitive landscape will be vital in ensuring sustained growth and providing high-quality healthcare services to Australians.

HCPA is an all-in-one solution for Healthcare providers, supporting them with registration, growth and consulting. Contact us here or call 03 9084 7472 to learn how we can help you succeed.

SOURCES | MarketLine Industry Report ‘Healthcare Providers in Australia’ |